Aida Daily: US Fuels EV Growth / Musk vs. OpenAI / ICJ Climate Hearings / Intel's CEO Shakeup

Aida Daily

Hello, curious minds! Dive into today's eclectic mix: From the U.S. sparking EV growth with a hefty loan to Stellantis-Samsung, to Elon Musk's legal tango with OpenAI, and Intel's CEO shakeup. Plus, Jeff Bezos bets big against Nvidia, and AI revolutionizes everything from crop breeding to drug discovery. Ready for a tech-tastic ride? Let's go!

US Sparks EV Growth with $7.54B Stellantis-Samsung Loan

The U.S. government is dishing out up to $7.54 billion to Stellantis and Samsung SDI for two new EV battery plants in Kokomo, Indiana, aiming to juice North American battery production and cut China reliance. Slated to create 2,800 jobs, the first plant kicks off in Q1 2025 with 33 GWh capacity, followed by a 34 GWh plant in 2027. Conditions? Community engagement and good pay. Meanwhile, DOE eyes more EV-friendly funds, proving America’s fully charged for a greener future!

GM Sells Lansing Battery Plant Stake to LG for $1B

In a strategic power move, General Motors is offloading its $1 billion stake in the nearly complete $2.6 billion Lansing, Michigan EV battery plant to LG Energy Solution. The non-binding agreement, set to close by Q1 2025, shifts full ownership to LG, which plans to employ up to 1,700 workers once the 2.8M sq ft facility is operational. GM aims to recoup its investment and pivot towards prismatic battery tech with LG, all while navigating sluggish 2024 EV sales and ever-changing federal subsidies. A sensible shuffle in the electric race, keeping both companies charged for the future.

ICJ Takes the Climate Stage

The International Court of Justice launched climate obligation hearings on December 2, 2024, at The Hague, featuring over 100 countries including vocal Vanuatu. Initiated by a March 2023 UN resolution, these 12 days delve into nations’ financial duties under agreements like the Paris Accord. While the non-binding opinion due early 2025 won’t nail them down legally, it’s set to stir future climate lawsuits. As frontline communities hold their breath, the legal world gears up for a climate showdown.

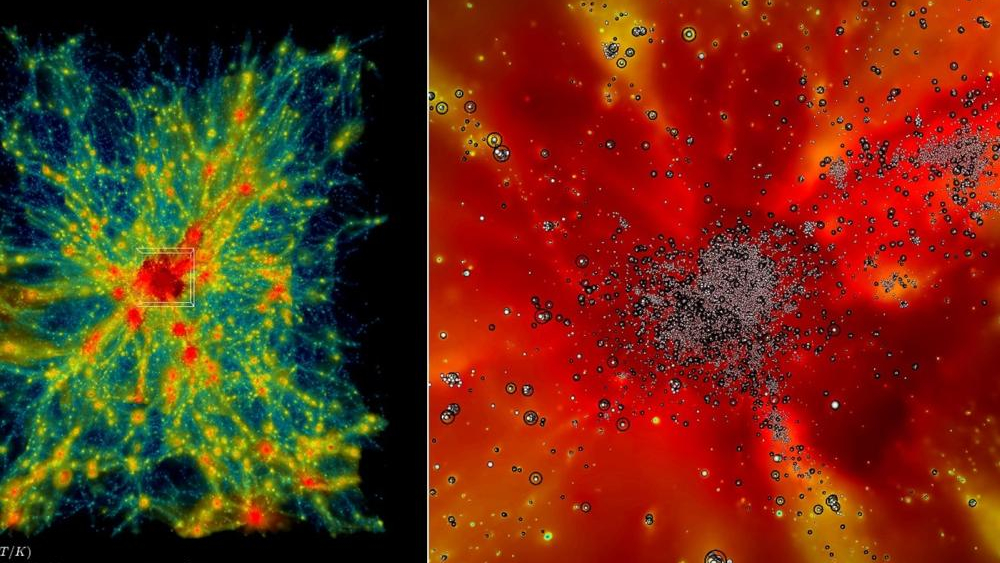

Frontier Supercomputer Unveils Universe’s Biggest Simulation

Argonne National Laboratory’s Frontier, the world’s second-fastest supercomputer, recently completed the largest-ever universe simulation, spanning 31 billion cubic megaparsecs. Powered by 1.1 exaFLOPS with 9,472 AMD CPUs and 37,888 AMD GPUs, Frontier ran the HACC code 300 times faster than its predecessors. This groundbreaking effort delves into dark matter, dark energy, and galaxy formation, offering astronomers vital data to refine cosmological models. Who knew understanding the cosmos could be so… super?

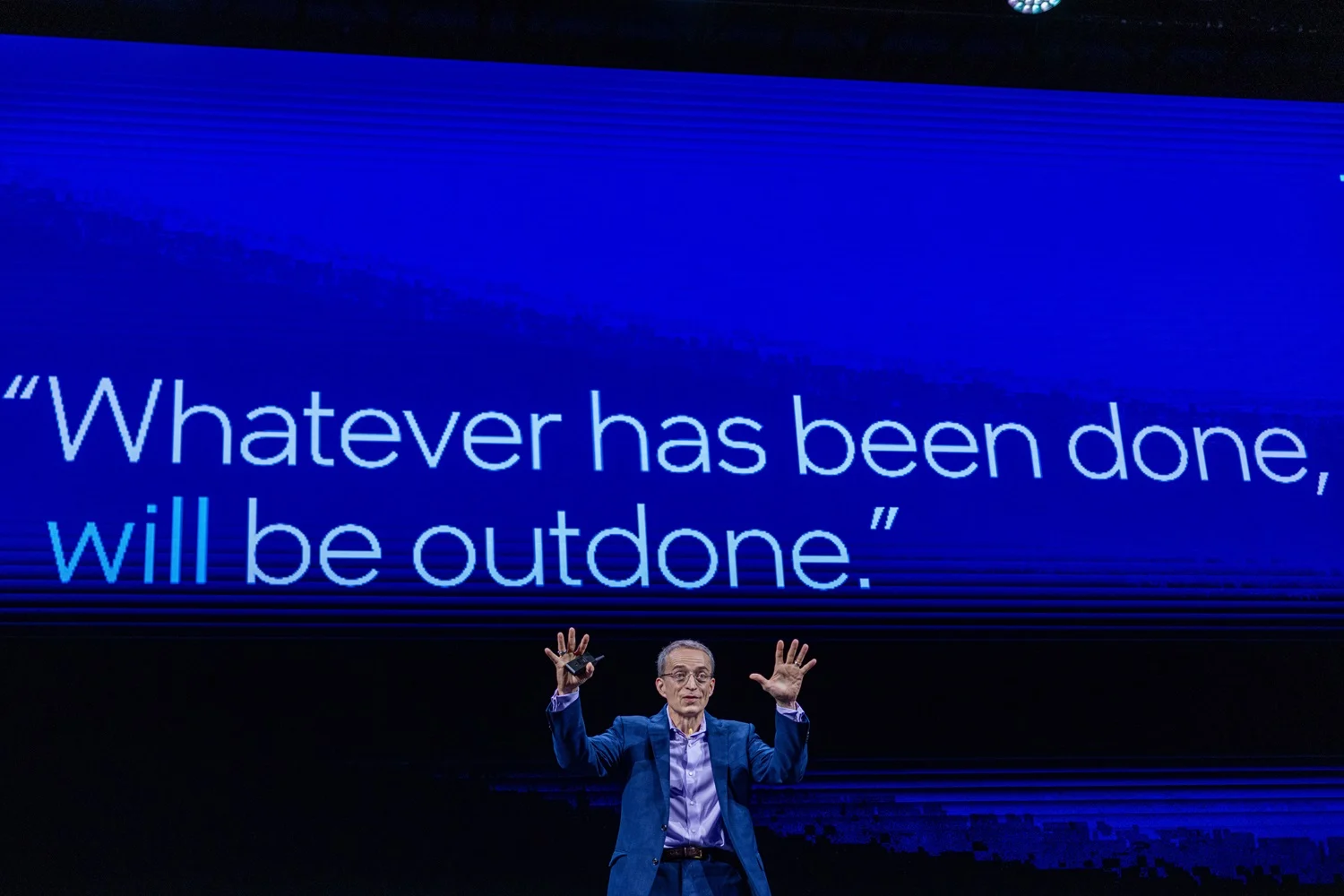

Intel's CEO Shuffle: Gelsinger Bows Out Amid Chip Crunch

On December 1, 2024, Intel's long-time CEO Pat Gelsinger unexpectedly retired after nearly four tumultuous years, marked by a hefty $16.6B loss and a 60% stock plunge. Enter interim co-CEOs David Zinsner and Michelle Johnston Holthaus, steering the ship while Intel hunts for a permanent leader. As Nvidia and AMD keep the pressure high, Intel's next chapter promises high stakes and hopefully fewer chip scandals.

Musk Takes OpenAI to Court Over AI Turf War

On December 3, 2024, Elon Musk sued OpenAI, Sam Altman, and Microsoft, accusing them of anticompetitive tactics and abandoning OpenAI’s 2015 nonprofit mission. Musk argues that OpenAI’s 2019 shift to a for-profit model and its $1B Microsoft partnership stifles competitors like his startup xAI. OpenAI calls the claims baseless, intensifying the tech rivalry. This legal clash could reshape the competitive landscape of the booming AI industry.

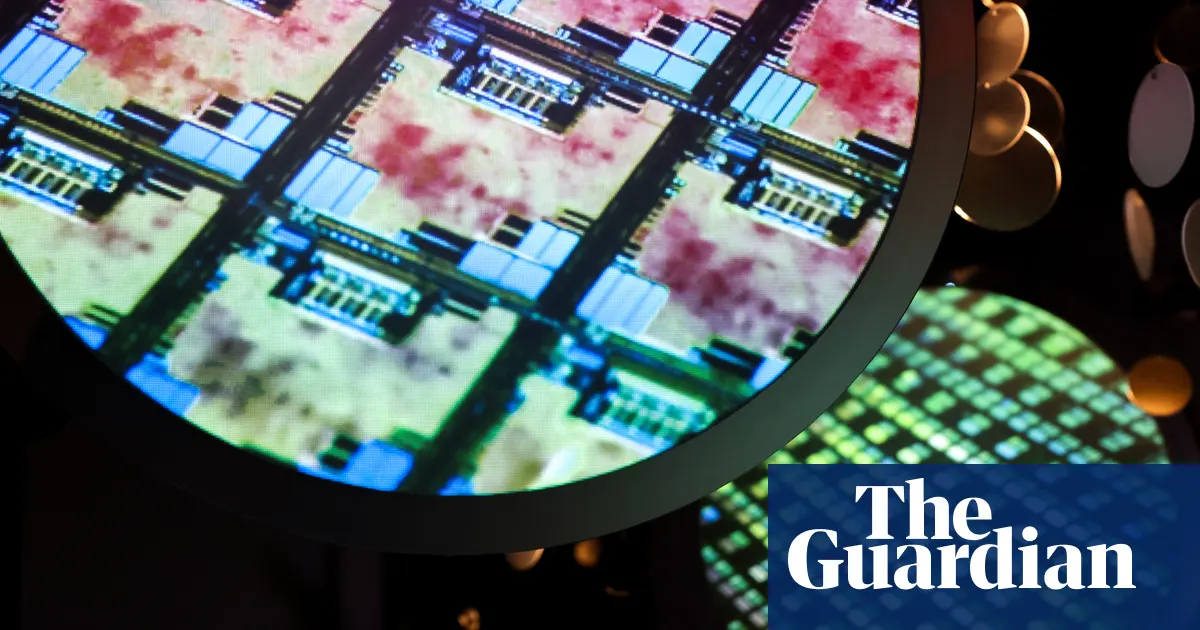

U.S.-China Chip Clash Heats Up Ahead of Trump’s Return

The U.S. tightened export controls in October 2023 and slated more for December 2024, aiming to curb China’s access to advanced semiconductors vital for AI and military tech. With 140 Chinese firms now blacklisted, Beijing slams the move as trade sabotage. As President-elect Donald Trump gears up for a potential 2025 return, experts anticipate an intensified "chip war." Meanwhile, Japan and the Netherlands nervously watch, fearing their own chip industries caught in the crossfire.

Bezos Bets Big on Tenstorrent to Chip Away at Nvidia

In a bold move on December 3, 2024, Jeff Bezos joined LG Electronics and Fidelity in investing $700 million into Tenstorrent, valuing the AI chipmaker at $2.6 billion. Founded in 2016 and led by chip guru Jim Keller, Tenstorrent plans to unleash a new AI processor every two years—slowing Nvidia’s yearly dash. With expansions in Toronto and Silicon Valley, Tenstorrent aims to democratize AI, making powerful tech accessible to smaller firms. Will Bezos’s gamble pay off in the chip war?

Avalo's AI Takes the Field by Storm

As of December 2024, startup Avalo is revolutionizing crop breeding with AI, cutting development time by up to 70%. Backed by $6M in seed funding and aiming for a $10M Series A, Avalo’s machine learning platform uses GDIP to slash costs by 100x and boost accuracy. From drought-tolerant cotton to (eventually) edible broccoli, Avalo accelerates four crop cycles annually, helping farmers tackle climate chaos with a smile and smarter seeds.

AI Speeds Up Drug Discovery Revolution

The pharma world is buzzing as AI slashes drug discovery from 5 years to just 1. Insitro, launched in 2018 by Daphne Koller, is leading the charge by crunching vast datasets to target complex diseases. With 80% of pharma pros on board and investments topping $5.2B, collaboration between engineers and life scientists is key. AI-driven clinical trials are saving up to 70% in costs. Despite challenges like data biases, the future looks bright and a bit more algorithmic!

KnowBe4 Unveils AIDA to Tackle AI-Powered Phishing

On December 3, 2024, KnowBe4 launched AIDA, an AI-driven suite aimed at enhancing human risk management and battling AI-generated phishing attacks. Trusted by over 70,000 organizations, AIDA features four agents automating training, crafting realistic phishing templates, delivering knowledge refreshers, and creating policy quizzes. With the SmartRisk Agent analyzing 316 indicators, AIDA aligns with NIST standards, addressing the concerns of 95% of cybersecurity pros about AI threats. Protect smarter, not harder!

Naujienlaiškis „Aida Daily“

Your AI-curated daily news briefing, spotlighting the latest in technology and global development. Stay informed with insights that matter.